If you're among the millions of homeowners that have an

Adjustable Rate. Mortgage (ARM) that's scheduled to adjust soon, now may be a good time to refinance into the security of a fixed–rate mortgage.

Why now?

Low Rates

Many people find that the longer they’re in their home, the easier and more comfortable the mortgage payments are to make – especially first time home buyers.

Carriene describes the process as follows:

Fill out an application. This can be done in person, online, or over the phone.

The lender runs a credit check to get your FICO score.

The lender runs a credit check to get your FICO score.

It also determines your expenses and income by looking at your financial portfolio.

The bank then determines if you qualify for a loan, and if so, what kind and for how much.

Is that true for you?

Here are a few things that are always helpful: Review your household budget. Does it need changes?

Start an emergency fund, or continue adding to your existing fund. Make a plan to knock out at least one piece of debt.

Make sure you’re taking full advantage of tax deductions and credits.

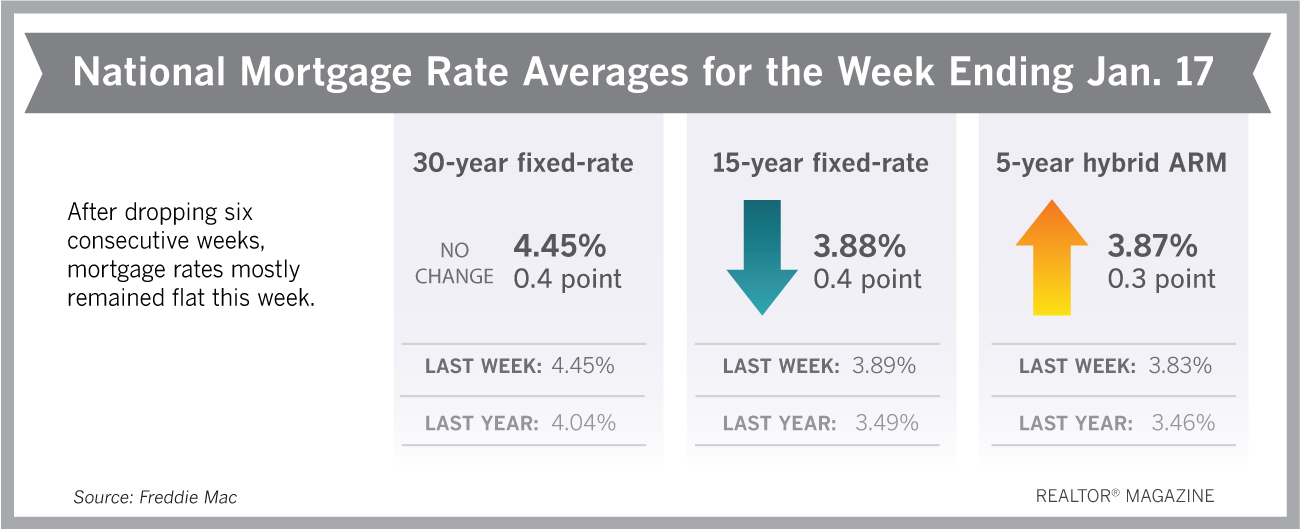

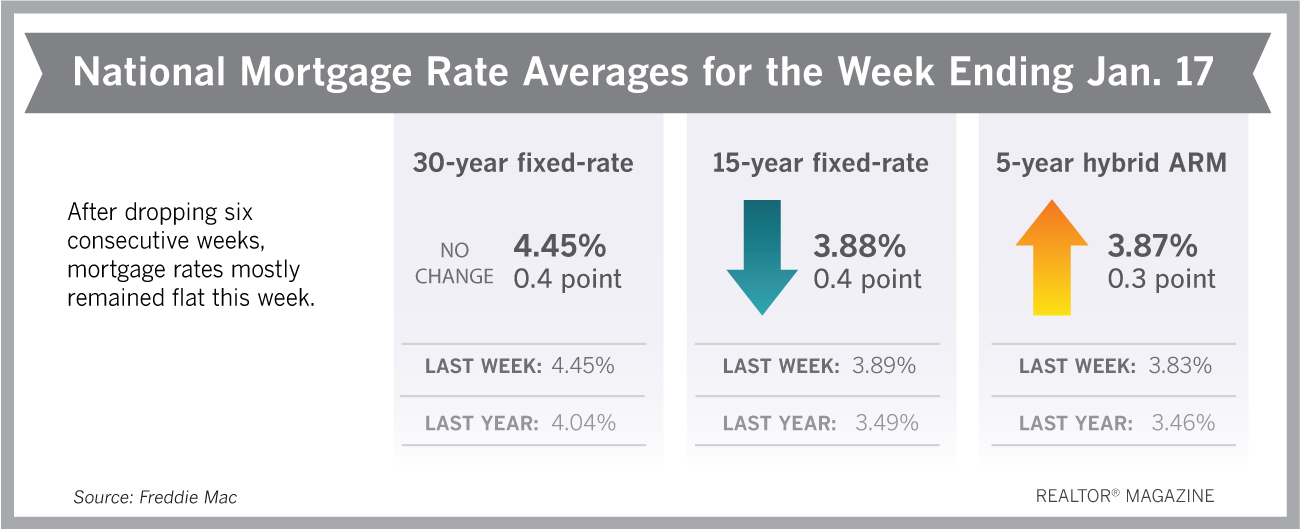

Today's mortgage rates remain at historic lows. They may not be as low as they were when you got your ARM 3–, 5– 7– or 10 years ago, but they remain very attractive. In fact, we recently experienced a nine–month low for the 30–year fixed–rate mortgage.

Peace of Mind

Ninety percent of today's homebuyers choose the 30–year fixed–rate mortgage — and, with good reason. It provides you with: Affordability — With the longer term, your payments are stretched out for a longer period, lowering your monthly payment.

Affordability — With the longer term, your payments are stretched out for a longer period, lowering your monthly payment.

Affordability — With the longer term, your payments are stretched out for a longer period, lowering your monthly payment.

Affordability — With the longer term, your payments are stretched out for a longer period, lowering your monthly payment.

Stability — Since your mortgage rate will remain the same for the entire term of your loan (aside from taxes and insurance that can increase over time), your mortgage is protected from inflation and you'll enjoy the financial security of consistent payments for 30 years.

Flexibility — If rates drop or you need to refinance for other reasons, you can do so without penalty in most cases.

You may also want to explore a 10–, 15– or 20–year fixed–rate mortgage. These loans provide the same benefits as the 30–year term, but your monthly payment will be higher due to the shorter term. You will, however, build equity faster, pay less interest over the life of your loan, and secure a lower rate.

To determine if refinancing to a fixed–rate mortgage is right for your situation, lean on your lender or financial professional for guidance. Also, check out our calculator to see how much your mortgage payments might be with a fixed–rate mortgage.

By completing a Loan Pre-Qualification you'll be on your way to locking in your interest rate and giving assurance to prospective sellers that you mean business. Pre-qualification is easy and can be done via email or over the phone.

By completing a Loan Pre-Qualification you'll be on your way to locking in your interest rate and giving assurance to prospective sellers that you mean business. Pre-qualification is easy and can be done via email or over the phone.

To start the process simply contact George Andersen. Once we receive your information We can start to work with you to tailor a loan specific to your needs. 801-550-1382

For more news and advice, head over to Precision Realty & Associates and speak to Carriene Porter a real estate professional. If you prefer a more personal touch, CALL 801-809-9866 today.

#Mortgage #UtahRealEstate #Selling #Buying

No comments:

Post a Comment